The latest housing market data from England and Wales reveals a fascinating story of contrasting fortunes across different regions, highlighting the complex and often divergent nature of Britain’s property market. Our analysis with BLG Development Finance of median house prices between March 2024 and March 2025 uncovers significant variations in market performance, with some areas experiencing remarkable growth while others face substantial declines.

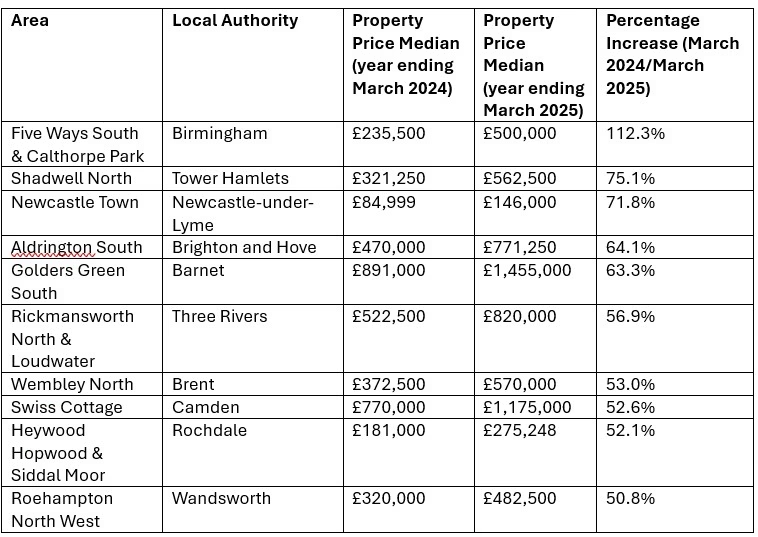

Top 10 neighbourhoods with the highest increase in property prices

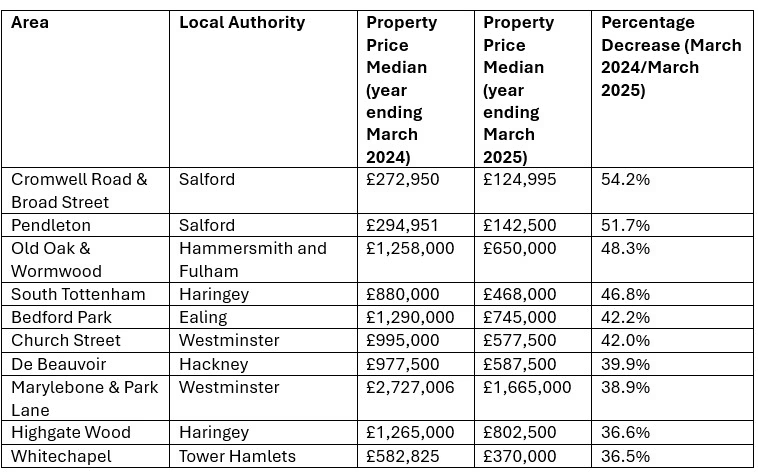

Top 10 neighbourhoods with the highest decrease in property prices

Methodology:

- We used property data from the Office for National Statistics, which looked at the median house prices for MSOA areas in March 2024 and March 2025. We then worked out the highest increase and decrease percentages from these two figures.

Conclusion:

These current patterns suggest a market that is realigning rather than fundamentally weakening, with clear opportunities in specific areas despite broader challenges.

The migration of value to suburban locations, particularly in London’s outer regions, might represent a lasting shift in the market’s structure. However, the significant price corrections in some prime central areas could also present opportunities for buyers who have been previously priced out of these markets.

This analysis emphasises the importance of detailed local market knowledge and suggests that while the overall market might be cooling, opportunities for both buyers and sellers continue to exist in specific locations. The key is understanding where these opportunities lie and what factors are driving local market performance.